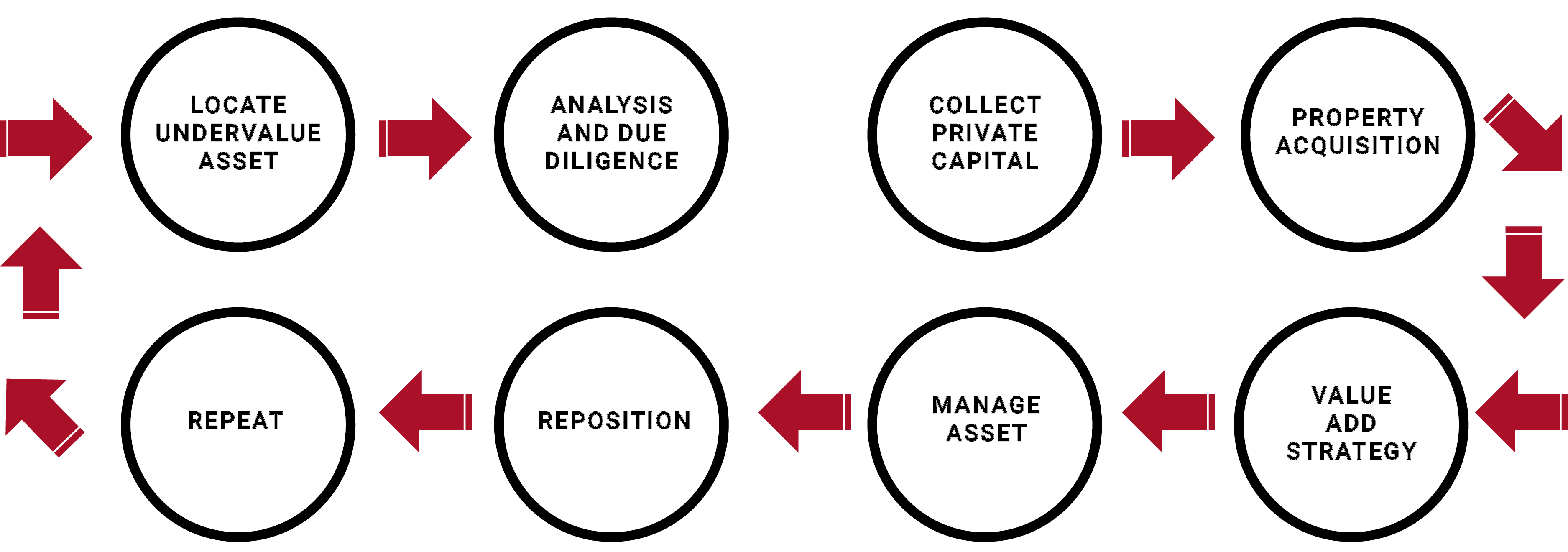

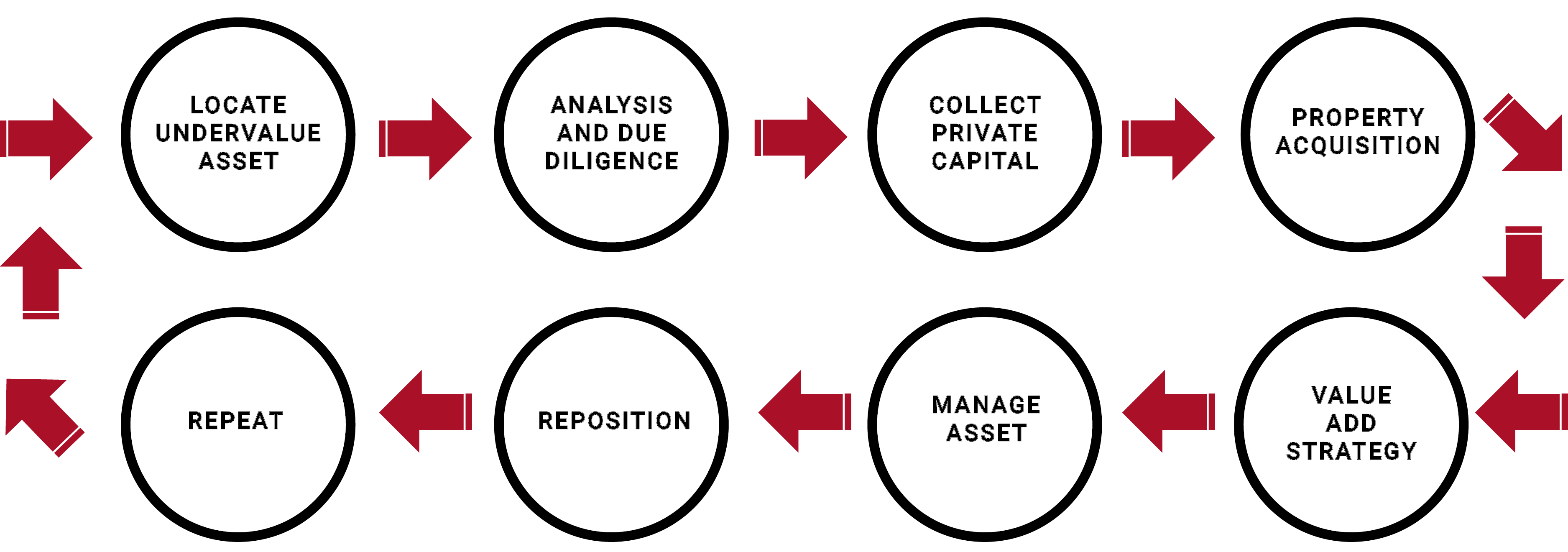

INVESTMENT STRATEGY

The name Diesel represents our strength and ability to get the job done.

While others are at the bottom of the hill, Diesel will be powering through.

STAY CONNECTED

DIRECT CONTACT

FOLLOW US

No Offer of Securities—Disclosure of Interests

Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.